"We see things as we are."

—Anais Nin

2nd Quarter 2024 Commentary • Kori Allen, CFP®

What will happen to the markets after the November election? Depending upon where a person stands on the political spectrum, the flavor of worry falls toward a clear “side.” We’ve become a nation that views issues in simple black and white terms.

It’s been a long, winding path to where we are—and argue—today. In the study of logic and philosophy there are three laws of thought, originally posited by Aristotle. They are: 1) the law of excluded middle; 2) the law of non-contradiction; and 3) the law of identity. These three laws do not encompass all possibilities, but they are particularly apparent today. The overarching premise of the law of the excluded middle is that if one thing is true, then its opposite is not true. In political terms, wedge issues exclude a middle. For decades campaigns have used wedge issues to excite emotions and motivate voters to the polls. Oftentimes, passionate voters may be well informed on the one issue and then are easily led to support the candidate or party on other issues beyond the wedge because of common ground. Following 9/11, President George W. Bush famously declared, “You’re either with us or against us” as he launched the “war on terror.” The middle was excluded.

Ironically, our hyper-partisan culture is also influenced by a digital exclusion of the middle. Simplistically, computer language is built on binary code: 1 is true and 0 is false. Layer on the algorithms that social media and most all commercial aspects of our digital lives employ, and we are led into one of two political camps or directed to specific products and services.

Consider how the founders created our democracy: structure and process were intended to cultivate middle ground. Compromise was to be valued. Checks and balances were designed for just that–balance, and uniting disparate–and common–needs and strengths.

When constructing portfolios and financial plans, we diversify and project for multiple scenarios. We endeavor to invest in non-correlated assets such as stocks versus bonds. It’s not as simple, though, as one or the other. Nuance exists within asset classes. A dividend paying stock might behave more similarly to a bond than a company stock in a growth industry or phase of innovation. We take a long-term view. Diversifying a portfolio allows us to invest for various opportunities, risks, and outcomes throughout business, market, and political cycles.

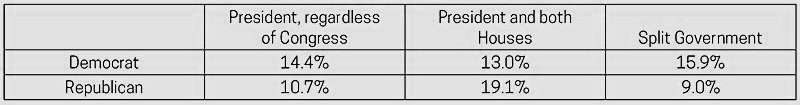

So, what happens to the markets if a Republican or Democrat presidential candidate wins? If we look at past statistics, it does not matter much. What matters more is the balance of power among the executive branch and both houses of Congress.

From 1946 - 2023, the S & P 500 generated the following returns:

To muddy this further: In the 38 years of Democrat Presidents, 84% of those years, the S & P 500 was up. In the 40 years of a Republican leader, 73% of those years were positive. (Information from Northern Trust Asset Management, January 2024 & Bloomberg)

On a recent webcast, Michael Townsend shared statistics from the Schwab Center for Financial Research. Please note this is from a different time frame and using a different benchmark, Ibbotson US Large Company Stocks. An investment of $10,000 from 1961-2023 grew to:

$102,293 Invested only when a Republican held office

$500,476 Invested only when a Democrat held office

$5,119,520 Invested, and stayed invested, regardless of party

As the saying goes, “the markets do not like uncertainty”, but we also know that humans fuel the markets and a very human emotion—anxiety—flares alongside it. Because of this, we do expect volatility in the markets leading up to the election. This is not uncommon.

We would be remiss to focus on only data and market analysis in light of the unusual circumstances of the current campaign season. These times are fraught with emotion and oftentimes a data dump can come across as lacking empathy.

As investment advisors, our ethics require us to be aware of potential conflicts of interest and to acknowledge and disclose them if they cannot be avoided. Sourcing data from multiple respected sources helps challenge and test our biases. We read multiple industry and investment firm analyses and search for neutral media and primary sources.

Still, we are human.

US markets and Treasuries have been the respected international standard for growth and stability. Our form of government, with checks and balances among the executive, judicial and legislative branches has ensured that change happens slowly. If markets hate uncertainty, our markets and government have been less uncertain than most. Still, we at Pearl Wealth invest globally for opportunities and to reduce political risk, among other risks.

We want to listen to your concerns: to understand you, your needs, and goals, as well as learn from you. We aim to earn your trust so that you can lean on us when market dynamics challenge your comfort in staying the course. As investment advisors we are confident that holding for the long-term, despite political winds, market gyrations and short-term uncertainty, will help you reach your goals. Discipline and the law of compounding brings success.

“That instability is inherent in the nature of popular governments, I think very disputable…

A representative democracy, where the right of election is well secured and regulated & the exercise of the legislature, executive, and judiciary authorities, is vested in select person, chosen really

and not nominally by the people, will in my opinion be most likely to be happy, regular and durable.”

—Alexander Hamilton

The views expressed represent the opinions of Pearl Wealth, LLC as of the date noted and are subject to change. These views are not intended as a forecast, a guarantee of future results, investment recommendation, or an offer to buy or sell any securities. The information provided is of a general nature and should not be construed as investment advice or to provide any investment, tax, financial or legal advice or service to any person. The information contained has been compiled from sources deemed reliable, yet accuracy is not guaranteed.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website. www.adviserinfo.sec.gov.

Past performance is not a guarantee of future results.