Psych!

1st Quarter 2023 Commentary • Kori Allen, CFP®

Did you ever have someone play that game on you in school? Or maybe, you played that game on someone? Tricksters would make up a story or pretend to start throwing a ball at your face or something similar, and as soon as they see agitation, they’d yell “psych!”. Theoretically it was funny to provoke fear, stress or anxiety. Now we play this game every day, depending upon how many news alerts, notifications or scrolling notices on a screen a person experiences. Most news feeds our normal human bias to perceive or anticipate negativity four times more than positive outcomes. Compound this with digital information consumption where we don’t read as carefully, nor in depth, than if it was on paper. This all conspires against our intent to invest for the long-term. It’s increasingly challenging for investors to hold the course amidst this barrage of short alarmist headlines. What’s more upsetting: “The Dow is down 143 points” or “The Dow is down .42%”? The information is the same, yet the media reports the former, since the latter isn’t as engaging.

We recently watched this in real time with the collapse of Silicon Valley Bank. Indeed, their executives did not manage their capital well, yet they did responsibly arrange for financing to resolve their capital shortcomings. They also did not manage their communications well. The ultra-connected Silicon Valley depositors and investors quickly spread their alarm and distrust, taking down the bank. The rapidity and magnitude of the fear was almost breathtaking. Understandably, we’ve all lived with stories of the Great Depression, so a bank run can generate inordinate fear, but we see this in less dramatic ways in individual stock swings or greater market volatility too.

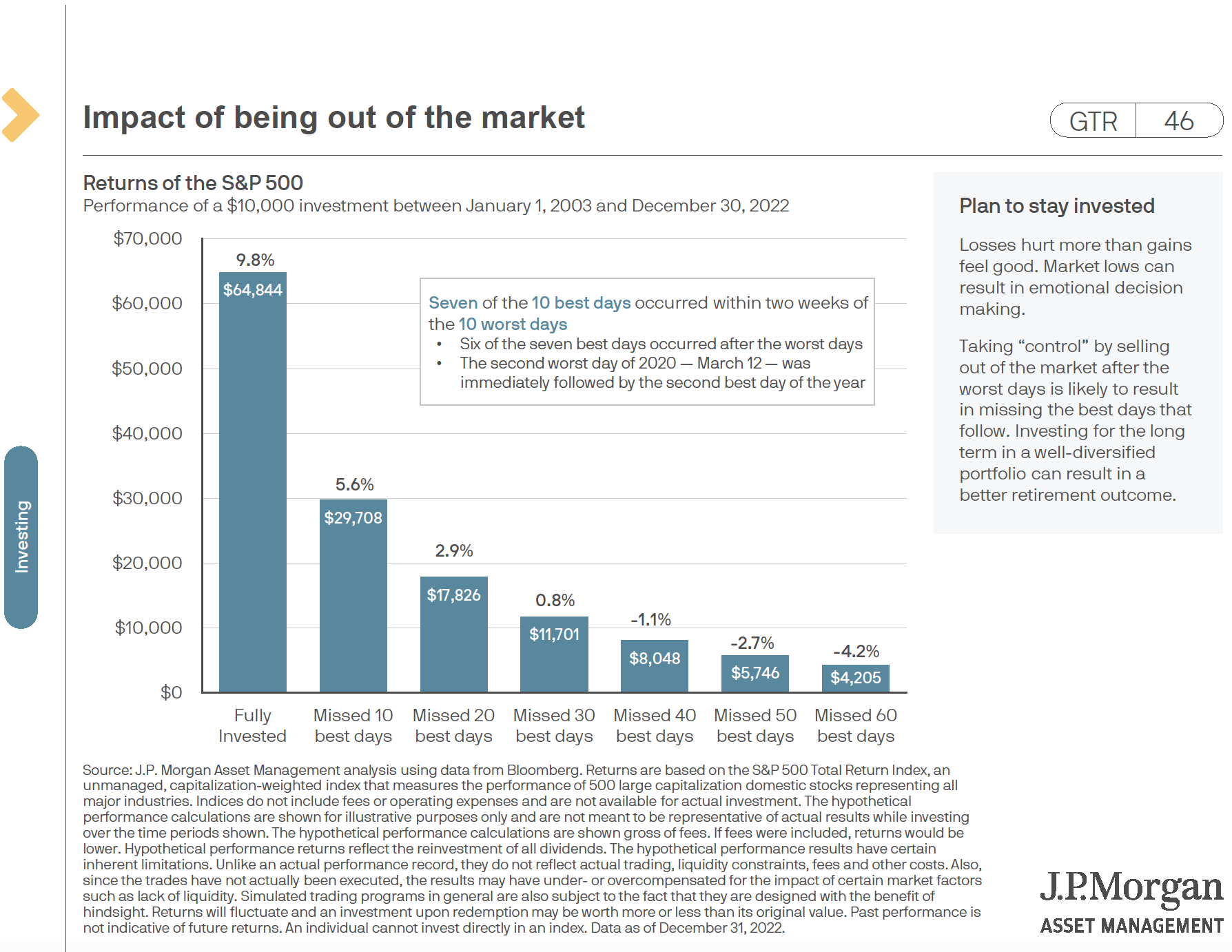

Below is possibly a familiar chart depicting why we investment advisors regularly remind our clients to hold for the long term. The information in the box is most important:

Seven of the 10 best days occurred within two weeks of the 10 worst days.

Six of the seven best days occurred after the worst days.

The second worst day of 2020 was immediately followed by the second-best day of the year.

A negative reaction can undermine an investors success.

As we build our portfolios for you, our stock selection criteria focus upon return on investment and the price we pay for the investment. This ratio, ROI/WACC, in our model portfolios, is about 30% greater than the benchmark, ACWI (All Country World Index). Look at this similarly to financing your home. You endeavor to finance at a low rate, and over-time and good stewardship of your home, you build equity. If you’ve looked at your mortgage statement shortly after establishing a loan, you might be discouraged that the equity hasn’t grown. Yet, over a year and years of reliable, consistent loan payments, home maintenance and upgrades, your discipline pays off. You are rewarded for your focus on the big picture. Sometimes,

“Patience is bitter, but it’s fruit is sweet”

–Jean-Jacques Rousseau

Disclosure: This commentary was prepared as general communication between Pearl Wealth and its clients. Financial plans and investment portfolios should be tailored to an individual’s unique circumstance; therefore, this should not be relied upon as research, investment advice, or a recommendation regarding any products, strategies, or any security in particular. This material is strictly for illustrative, educational, or information purposes and is subject to change as conditions vary. Investment involves risk, including possible loss of principal.